Free Zone Solutions for Every Business

Free Zone

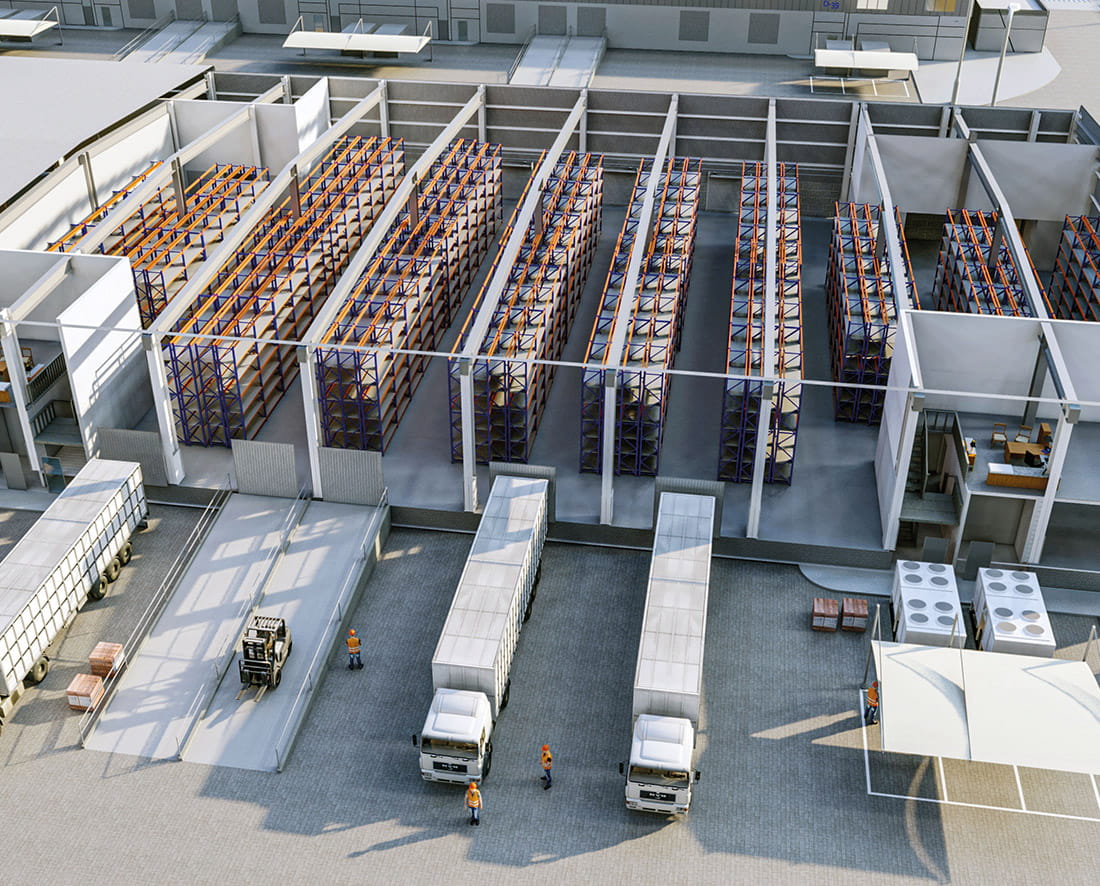

The Free Zone in KEZAD offers a host of advantages for clients based on their business strategy and requirements.

The Free Zone jurisdiction allows 100% foreign ownership in companies and is suitable for startups, wholesale distributors, re-exporters and companies requiring warehousing activities. Free Zone facilities are also suitable for industrial projects targeting markets outside the GCC region.

Features & Advantages of Free Zone Business Set Up

Whether you are a small startup or an established large-scale business, KEZAD Group has customised solutions available in its Free Zone. Here you will find further information on the benefits and procedures to help you get started.

Category

Features and Advantages

Ownership

Taxes

VAT

Sales in Local Market

Customs Duty

- No customs duties within Free Zone

- Standard customs duty for goods in transit:

- Between points of entry (seaports/airports/borders) and Free Zones

- Between Free Zones and point of exit (export).

- Standard customs duty for sales to the local market (import) and GCC (first point of entry - import).

- Local customs duties applicable for imports into other countries.

Capital & Profit Repatriation

Labour Law

Dual Licence for Free Zone Companies

Business Facilities

Set up Your Business

.svg?iar=0&rev=9d432799014d47c9abce3ac24f471042&hash=44FB8932884297251BF24668E64F0FB5)